Hey there, taxpayers! If you're scratching your head wondering, "Where do I mail my AZ state tax return?" you're not alone. Filing taxes can feel like navigating a maze, but don't sweat it—we’ve got your back. Whether you're a first-timer or a seasoned pro, knowing the correct mailing address for your Arizona state tax return is crucial. After all, you don’t want your hard-earned refund delayed because of a wrong address, right?

Let’s face it—tax season can be stressful, but it doesn’t have to be. This guide will walk you through everything you need to know about mailing your Arizona state tax return. From the correct mailing address to important deadlines and tips to make the process smoother, we’ve got all the answers you need.

So, grab a cup of coffee (or your favorite beverage), sit back, and let’s dive into the world of Arizona state taxes. By the end of this article, you’ll feel confident and ready to file your return without any hiccups. Let’s get started!

Read also:How Left Eye Died A Comprehensive Look At The Tragic Event

Understanding Where to Mail Your AZ State Tax Return

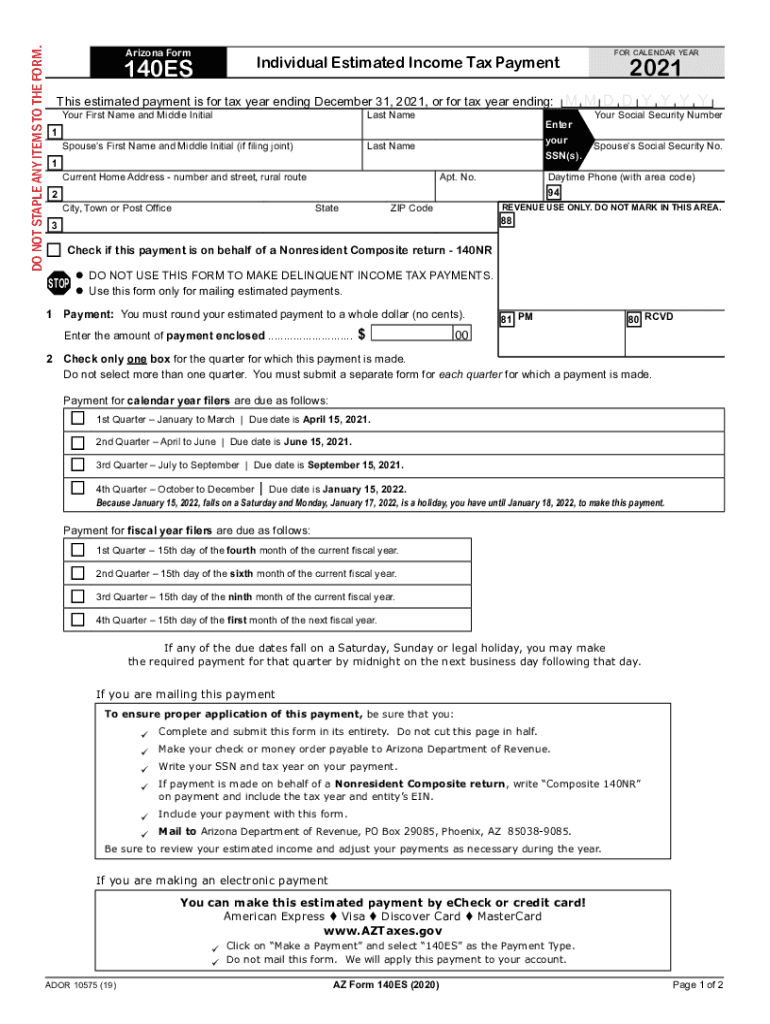

Before we jump into the nitty-gritty details, let’s break down the basics. When it comes to filing your Arizona state tax return, the mailing address depends on several factors, such as whether you’re filing individually or jointly. Yep, it’s not a one-size-fits-all situation, so it’s essential to double-check the address that applies to your specific case.

For most Arizona taxpayers, the correct mailing address is:

Arizona Department of Revenue

PO Box 29058

Phoenix, AZ 85038-9058

But hold up—if you’re filing a business tax return, the address might differ. Always verify the details on the Arizona Department of Revenue’s official website to ensure accuracy.

Why Does the Mailing Address Matter?

You might be thinking, "Why does the mailing address even matter?" Well, my friend, it matters a lot. Sending your tax return to the wrong address can lead to delays in processing, lost documents, or even penalties. Nobody wants that, especially when you’re expecting a refund.

Here’s the deal: The Arizona Department of Revenue processes thousands of tax returns every year. If your return ends up at the wrong location, it could get lost in the shuffle. To avoid any headaches, always double-check the address before dropping your envelope in the mail.

Read also:Zodiac Sign For October 27 Discover The Mystical Traits Of Scorpio

Key Factors That Affect the Mailing Address

Not all tax returns are created equal. Here are some factors that might influence the mailing address for your AZ state tax return:

- Filing Status: Are you filing as single, married filing jointly, or head of household? Each status might have a slightly different address.

- Payment Method: If you owe taxes, you’ll need to include a payment with your return. Make sure to check if the payment needs to be sent to a separate address.

- Amended Returns: If you’re filing an amended return, the mailing address might differ from the one used for your original return.

Pro tip: Always refer to the instructions provided with your tax forms to ensure you’re using the correct address.

Important Deadlines for AZ State Tax Returns

Now that we’ve covered the mailing address, let’s talk about deadlines. Missing the tax deadline can result in penalties and interest, so it’s crucial to file on time. For most Arizona taxpayers, the deadline is April 15th, but don’t forget to check if there are any extensions or exceptions that apply to your situation.

If you’re unable to meet the deadline, you can request an extension by filing Form 1040X. Keep in mind that an extension only gives you more time to file—not to pay. If you owe taxes, you’ll still need to pay the estimated amount by the original deadline to avoid penalties.

What Happens If You Miss the Deadline?

Missing the tax deadline isn’t the end of the world, but it can come with consequences. Here’s what you need to know:

- Failure-to-File Penalty: If you don’t file your return on time, you could face a penalty of 5% of the unpaid taxes for each month your return is late, up to a maximum of 25%.

- Failure-to-Pay Penalty: If you owe taxes and don’t pay by the deadline, you’ll be hit with a penalty of 0.5% of the unpaid taxes for each month the payment is late, up to a maximum of 25%.

Bottom line: File and pay on time to avoid unnecessary fees and penalties.

Tips for Filing Your AZ State Tax Return

Filing your Arizona state tax return doesn’t have to be a hassle. Here are some tips to make the process smoother:

- Double-Check Your Forms: Before mailing your return, make sure all the information is accurate and complete. A single mistake could delay processing.

- Include All Required Documents: Don’t forget to include any supporting documents, such as W-2s, 1099s, or payment vouchers.

- Use Certified Mail: If you want proof of delivery, consider using certified mail with a return receipt. It’s a small price to pay for peace of mind.

By following these tips, you’ll be well on your way to a stress-free tax season.

Common Mistakes to Avoid When Mailing Your AZ State Tax Return

Even the most careful taxpayers can make mistakes. Here are some common errors to watch out for:

- Incorrect Mailing Address: As we’ve discussed, using the wrong address can cause delays or even result in your return being lost.

- Missing Information: Failing to include all required information or documents can lead to processing delays.

- Not Signing the Return: A unsigned tax return is like a blank check—it won’t get processed until it’s signed.

Take your time and review your return carefully before mailing it. Trust me, it’ll save you a lot of headaches down the road.

How to Avoid These Mistakes

Here’s a quick checklist to help you avoid common mistakes:

- Verify the mailing address using the Arizona Department of Revenue’s website.

- Double-check all the information on your tax forms for accuracy.

- Ensure all required documents are included with your return.

- Sign and date your return before mailing it.

Simple, right? Following this checklist will help you avoid costly mistakes and ensure your return is processed without any issues.

Where to Find More Information

If you’re still unsure about where to mail your AZ state tax return, there are plenty of resources available to help. The Arizona Department of Revenue’s official website is a great place to start. They provide detailed instructions, FAQs, and contact information for additional assistance.

Additionally, you can reach out to a tax professional or accountant for guidance. They can help you navigate the complexities of tax filing and ensure everything is done correctly.

Can I File My AZ State Tax Return Online?

Absolutely! In fact, filing online is often faster and more convenient than mailing your return. The Arizona Department of Revenue offers an online filing option through their website. Plus, you’ll receive confirmation of receipt and processing updates, which can give you peace of mind.

However, if you prefer the traditional method of mailing your return, that’s perfectly fine too. Just make sure to follow the guidelines we’ve covered in this article.

Conclusion: Where Do I Mail My AZ State Tax Return?

Alright, folks, that’s a wrap! By now, you should have a clear understanding of where to mail your AZ state tax return and how to avoid common pitfalls. Remember, the correct mailing address is:

Arizona Department of Revenue

PO Box 29058

Phoenix, AZ 85038-9058

But always double-check the details based on your specific filing situation. And don’t forget to file on time to avoid penalties and interest.

If you found this guide helpful, feel free to share it with your fellow taxpayers. And if you have any questions or need further clarification, drop a comment below. We’re here to help!

Table of Contents

- Understanding Where to Mail Your AZ State Tax Return

- Why Does the Mailing Address Matter?

- Key Factors That Affect the Mailing Address

- Important Deadlines for AZ State Tax Returns

- What Happens If You Miss the Deadline?

- Tips for Filing Your AZ State Tax Return

- Common Mistakes to Avoid When Mailing Your AZ State Tax Return

- How to Avoid These Mistakes

- Where to Find More Information

- Can I File My AZ State Tax Return Online?